The Teamsters Canadian Pension Plan Focuses on Your Future.

The Teamsters Canadian Pension Plan (“TCPP”), is dedicated to ensuring our members are able to retire with a secure pension they can rely on. And just like with any other preparations in life, there are ups and downs, which we monitor and adjust for in order to stay on track. While managing the TCPP, we keep one focus in mind: Our members’ future.

What is the Teamsters Canadian Pension Plan?

What is the Teamsters Canadian Pension Plan?

The TCPP is known as a negotiated cost pension plan. What that means is that negotiated contributions are made as specified in collective bargaining agreements, and benefits are targeted to be paid out based on the defined formulas as set out in the TCPP. So, while you work, your employer is making contributions on your behalf to the TCPP that accumulate and ultimately provide you with a pension benefit. In some cases, members may also contribute to the TCPP. The TCPP is designed to provide our members with a secure pension they can rely on.

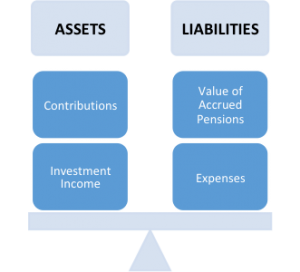

Every pension plan has assets and liabilities, but their characteristics differ depending on the design of the plan. It is important to the TCPP that your accrued pension benefits are not reduced. The TCPP attempts to do this by maintaining a balance between assets and liabilities.

How are Pension Plan Assets Invested?

At the TCPP, we have the benefit of taking advantage of the strength of Teamsters Canada. Several Teamsters pension plans like the TCPP have come together to form the Teamsters Canada Master Trust, a collective investment fund. There are many key advantages to the collective investment fund as follows:

- Economies of scale

- Lower administration costs

- Access to more diversified investments

- Maintaining separation and autonomy

One of the key methods that the TCPP uses to protect your accrued benefits is through a liability-driven investment (“LDI”) strategy, where the focus is on the funded stability of the plan.

One of the key methods that the TCPP uses to protect your accrued benefits is through a liability-driven investment (“LDI”) strategy, where the focus is on the funded stability of the plan.

Other pension plans may focus on seeking more return with greater risk. You may occasionally hear about double-digit investment returns in these plans, however, that’s not always the case. In return-seeking plans, there are good years and bad years.

Under an LDI strategy, as liabilities increase in value so do assets, and the opposite is also true. With assets and liabilities moving in tandem, this results in a relatively stable funded position. Typical LDI strategies involve investing in, for example, long term bonds. Although the strategy may realize lower returns than when the fund is more return-seeking, this strategy reduces the mismatch risk between assets and liabilities and also provides high benefit security for plan beneficiaries. An LDI strategy cannot guarantee that funding deficiencies will never arise, but the strategy can make these deficiencies less likely.

The main goal that the TCPP aims to achieve with an LDI strategy is the security of your accrued benefit—to provide our workers with a secure pension they can rely on during retirement. Another benefit of the LDI strategy is it increases the stability of your negotiated contributions compared to if the plan was invested in more return-seeking assets.

The Teamsters Canadian Pension Plan’s decisions are based on respect, justice and equality for all our members. The TCPP aims to ensure the benefits that you accrue while you work are paid to you at retirement.