You have questions, we have answers

Below are some commonly asked questions.

If you are a Teamsters Canadian Pension Plan member, please contact the administrator of your division for all questions pertaining to plan provisions or other administrative questions.

BECOMING A MEMBER

- What are some of the advantages of joining the TCPP?

- How can my group join the TCPP?

- From which industries are TCPP members coming from?

UNDERSTANDING THE PENSION PLAN

- What are the main objectives of the Board of Trustees?

- How is the TCPP fund performing?

- How is the TCPP fund administered?

- How is the level of benefits determined?

- What is the difference between a Defined Benefit (DB) Plan & a Defined Contribution (DC) Plan?

LIFE CHANGES

- How do I change my address/beneficiaries?

- What happens upon a divorce or after the end of a common-law relationship?

- I have a separation agreement/court order being drafted but not finalized yet. Can I remove my spouse and designate someone else in the beneficiary form?

- I am leaving my current employer and moving to another company. Can I access my benefit?

- What happens to my benefit if I die (pre-retirement)?

RETIREMENT PLANNING

- When can I retire, and what monthly options are available?

- What is my pension benefit amount?

- Why is my pension reduced if I retire early?

- What is the difference between a locked-in amount and a non-locked-in amount?

READY TO RETIRE

- I want to retire; what do I have to do to receive my TCPP pension?

- When can I retire, and what monthly options are available?

- Can I take my pension as a lump sum?

RETIRED

Q: What are some of the advantages of joining the TCPP?

- The TCPP is one of the best performing pension plans in Canada. It is well funded and well managed.

- Because of its size, the TCPP can afford to use the best possible professional, investment and administrative services.

- Expenses are pooled among all participating groups, which means considerable savings for all.

- Excess returns of the fund are available to improve benefits to members rather than to reduce employer contributions as is the case in some other plans.

- Participating groups retain independence within the structure, ensuring that they can be responsive to the needs of their members and can design the retirement benefits that suit their specific needs and financial means.

- There has been an increased responsibility placed on individuals to save for their retirement. Therefore, an employer/union-sponsored retirement savings plans such as the TCPP is encouraged so that members will have an additional source of income at retirement.

- The TCPP is a multi-employer pension plan, therefore its members may frequently change employers, but will always continue to participate in the plan, as long as their employers are covered by the TCPP.

Q: How can my group join the TCPP?

Many groups have come to appreciate the vision that gave rise to the TCPP. The current plan uses the services of highly qualified experts to support its growth, while maintaining its flexibility and providing many advantages to its members. If you are interested in learning how your group can join the TCPP, please contact your union representative.

Q: From which industries are TCPP members coming from?

TCPP members come from a wide variety of industries and cover a vast spectrum of skills: they are construction workers, dairy workers, hydro workers, road builders, car carriers, transportation shippers, office workers, brewery and bottling plant workers and the list goes on!

Q: What are the main objectives of the Board of Trustees?

- To provide a simple cost-effective way for members employed in smaller to larger organizations to secure good pension benefits by negotiating contributions (through a variety of formulas) to the plan and trust.

- To ensure the delivery of the pension benefits promised to the members, considerable effort is put into the development of a sound investment strategy that will protect the Plan’s assets and produce rates of investment earnings necessary to ensure the Plan will be able to meet its obligations.

- To allow different levels of contributions and benefits by the various groups that participate in the plan. In this way, individual groups of members control the level of pension they provide for themselves. The pension benefits provided to a given group of members are basically determined by their demographic characteristics (i.e., age, service, etc.) and their negotiated contributions.

- To create a flexible structure available to Teamsters across Canada. Such a structure provides a national entity with significant local autonomy. In this way, groups of members have a voice in their own level of pension and the payment provisions as they apply to them.

- To minimize costs by pooling small groups into a large one. In this way, the plan can obtain the best possible professional, investment and administrative services at a cost much below what a small group could obtain on its own.

Q: How is the TCPP fund performing?

The TCPP has experienced spectacular growth, especially when you consider that the fund, which was worth less than $400,000 in 1981, exceeded 915 million dollars at the end of 2016.

The TCPP fund is among the best performing pension funds of its kind in Canada.

An important fact to note is that the excess returns of the fund (i.e., returns in excess of those anticipated by the actuary to satisfy the plan’s obligations) are available to improve benefits to members rather than to reduce employer contributions as is the case in some other plans.

The Board of Trustees consistently implements policies and procedures that ensure the financial well being of the TCPP and all its participating Divisions.

The Board’s focus on investment policy has included the creation of the investment sub-committee. This group dedicates considerable time and resources to monitoring changing economic trends and making appropriate recommendations to the Board that are consistent with one of the TCPP’s main objectives of ensuring the delivery of promised benefits. This way, the TCPP’s investment policy can be modified periodically as conditions warrant.

The Board has also implemented an investment structure that allows each Division to develop an investment policy (asset mix) that appropriately reflects the obligations specific to that Division.

Q: How is the level of benefits determined?

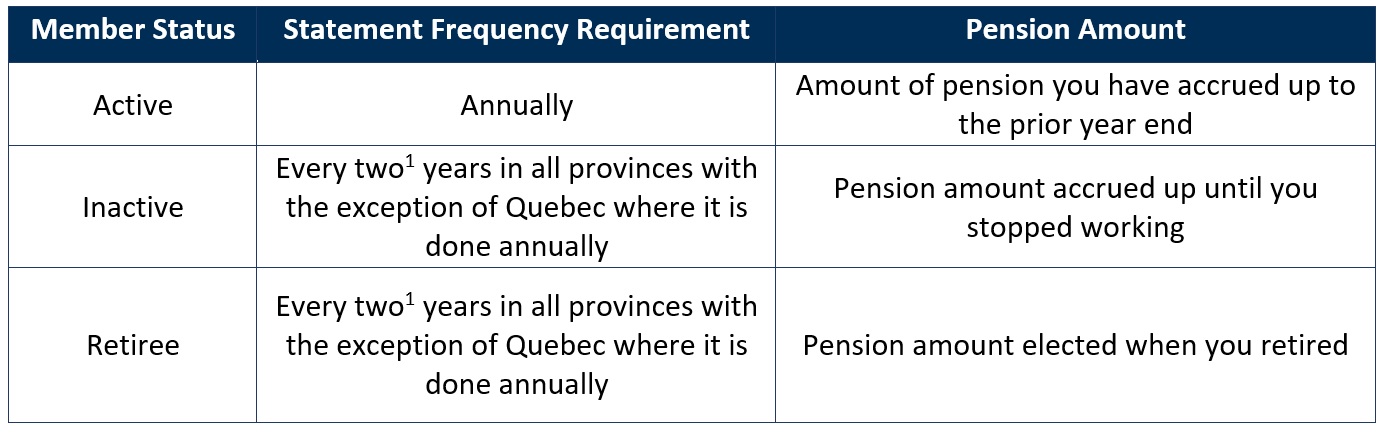

The TCPP structure allows each Divisional Retirement Committee to respond directly to its members’ needs according to its capability to pay benefits. Retirement benefits reflect the amounts contributed to the overall fund for members of that Division and investment returns that are credited to that Division once expenses have been deducted. Obviously, the more money that goes into the fund, the more there is to distribute, as illustrated here.

Please refer to “How is the TCPP fund performing?” for more information on investment performance and to “How is the TCPP fund administered?” for additional information on expenses.

Since Divisional Retirement Committees have the autonomy and flexibility to determine the retirement benefits their members will receive, this leaves room for a variety of approaches. For example, Divisions can have provisions regarding surviving spousal benefits, early retirement subsidies and ad hoc pre or post-retirement indexing of pensions that suit their particular needs. Each Division negotiates its contributions separately and therefore, benefits are designed according to what its members can afford.

The level of benefit each group can afford is largely related to the level of contribution, but it is also affected by the demographic characteristics of the group. For example, a comparatively higher contribution is required for a group of older members than for a younger group to provide the same $1 of pension at retirement.

Retirement benefits may vary considerably from group to group. However, as a matter of policy determined by the Board of Trustees, the plan benefits other than benefits at retirement are the same or similar for all Divisions *. These include:

- benefits upon death before retirement

- benefits upon termination of membership

- benefits upon disability

The above benefits represent a small part of the cost of a pension plan and the Board thus ensures a certain degree of uniformity among Divisions.

* Except where minimum pension legislation applies.

Q: How is the TCPP fund administered?

CIBC Mellon, the trust company that holds the pension fund debits and credits the following items directly to each Division:

- Debits

- Benefits paid to beneficiaries

- Expenses incurred by the Retirement Committee

- Professional fees directly related to the Division

- Pro-rated share of general expenses

- Credits

- Contributions

- Returns of the fund, reflecting the investment policy adopted by the Division’s Retirement Committee

Certain expenses related to the Board of Trustees are shared on a prorated basis among Divisions. The Board is made up of representatives from each Division and takes great care to ensure that each Division’s pension benefits are well funded and well managed, minimizing expenses and dedicating a maximum amount of the plan’s assets to members’ benefits. Annual expenses for all Divisions currently represent less than 1% of the TCPP fund market value. If they operated separately, expenses for each Union or Employer group would be significantly higher.

The pooling of certain costs is an advantage that highlights one of the main reasons for the success of the TCPP. Employers may hesitate to set up or maintain a pension plan individually because professional and administrative costs would be too high compared to the contributions and the potential returns. By joining the TCPP, they benefit from the professional resources of a very large pooled fund as well as cost-effective administration.

Q. What is the difference between a Defined Benefit (DB) Plan & a Defined Contribution (DC) Plan?

Refer to our web post on workplace pension plans:

Q: How do I change my address/beneficiaries?

Each Division of the TCPP has appointed an administrator to handle the day-to-day operations of the Plan, including the maintenance of member records. Please refer to the Contact page to find out who the administrator of your division is to report any changes to your personal information. You can also use the online form on this website to report any changes to your contact information.

To change your beneficiaries, you should contact your Divisional administrator to request a designation of beneficiary form. It is important to keep this information current so the Plan can keep you updated about your pension.

Q: When can I retire and what monthly options are available?

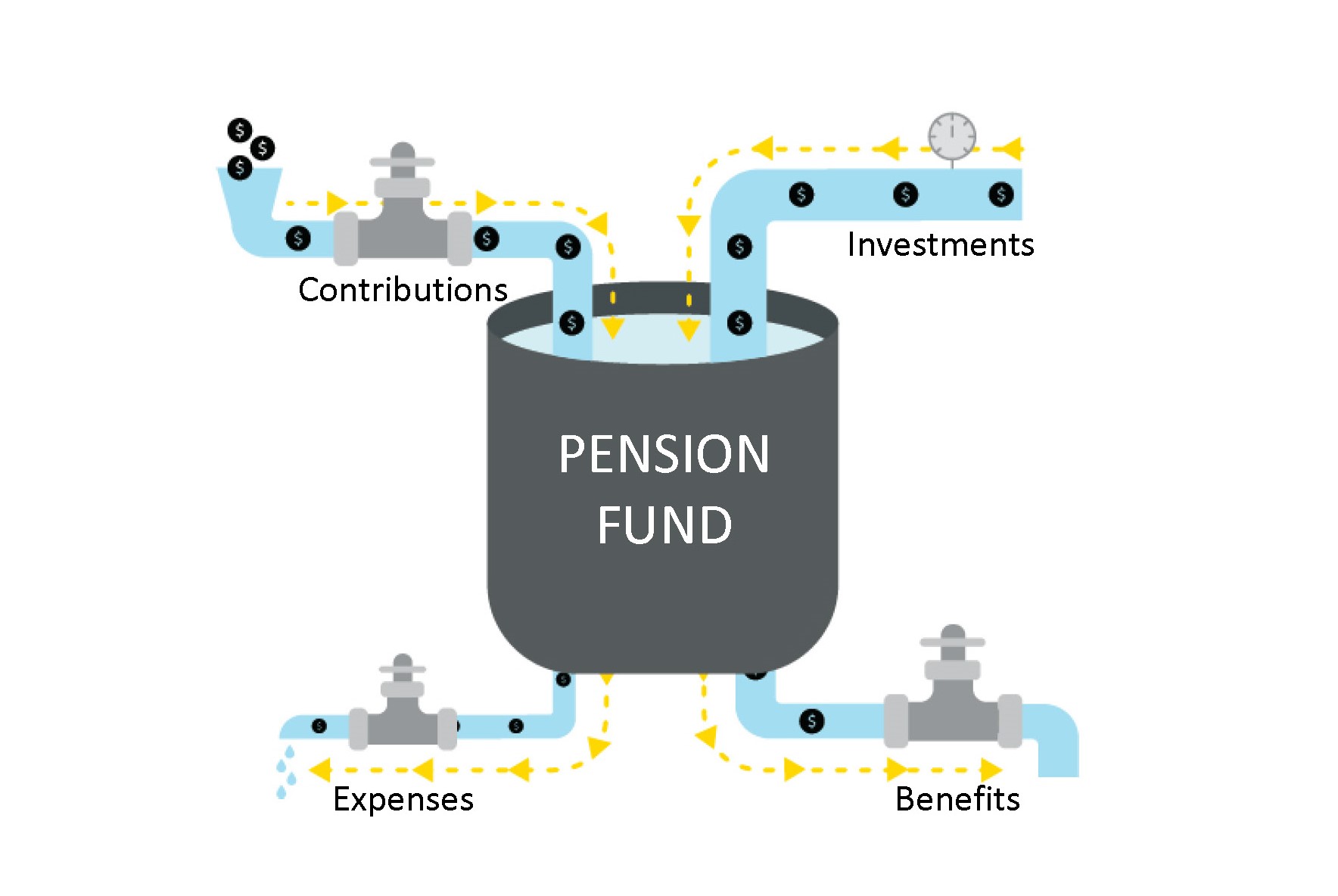

The normal retirement age under the TCPP is age 65, and you can retire as early as age 55 with a reduced pension. If you are actively employed by a participating employer of the TCPP, you will receive an annual pension statement which will outline the date you are eligible to retire with or without a reduction.

The options available to you may vary by division and can provide more or less protection to your spouse/beneficiary and result in differing pension amounts. The value of your pension (i.e. the present value of future payments) is the same under all options. Please contact your Divisional administrator for details.

Q: I am leaving my current employer and moving to another company. Can I access my benefit?

After no contributions are made on your behalf for 24 consecutive months, you terminate your membership with the Plan. Once 24 months have passed, you will receive a termination statement with the options available to you regarding your pension entitlement for the period you worked.

The 24-month period is needed due to the nature of a multi-employer plan. There are times employees change employers within the same plan or may have a period with no work that should not trigger a termination.

However, note that for Quebec members, legislation requires that termination statements be provided within 60 days after the date on which the Retirement Committee has been informed that the member has ceased to be an active member (provided that you are not laid off).

Q: What happens upon a marriage breakdown?

In the event that there is a change to your marital/common-law relationship status, due to marriage breakdown, your former spouse may be entitled to a portion of the pension benefit you earned during the marriage in accordance with the applicable legislation.

If you have had a marriage/common-law relationship breakdown and you have a court order or agreement or are in the process of having one drafted, please contact the Divisional administrator to discuss how this may affect your pension.

Q: Why is my pension reduced if I retire early?

Your pension from the Plan is payable starting on your normal retirement date (your 65th birthday). The earliest you can start your pension is your 55th birthday. Retiring early, prior to age 65, may result in a lower amount of pension payable as you will receive your pension for a longer period of time.

Q: I want to retire, what do I have to do to receive my TCPP pension?

You must contact the Divisional administrator at least 60 days prior to your intended retirement date who will provide you with an application form for retirement. The completed paperwork along with any additional required documentation must be submitted to the Plan Administrator prior to the commencement of your pension benefit.

Q: Can I take my pension as a lump sum?

If you are younger than age 55 when you leave employment, you have the option to transfer the commuted value of your pension.

If you are over age 55 and qualify for a small pension under applicable pension legislation, you have the option to receive the commuted value of your pension either as a cash lump sum or a transfer from the Plan.

Q: What is the difference between a locked-in amount and a non-locked-in amount?

There is a legislative requirement whereby pension benefits must be used to provide retirement income and cannot be received in a lump sum cash amount (locked-in). This is meant to ensure that members use the money for retirement income.

In some circumstances the money is non-locked-in. For example, if your monthly pension payable at age 65 is considered a small pension under applicable pension legislation, then the value of the pension is non-locked in and you will be able to receive the commuted value of your pension either as a cash lump sum or transfer from the plan.

Please contact your Divisional administrator for further details.

Q: What happens to my benefit if I die (either pre-retirement or post-retirement)?

If you die prior to retirement, applicable provincial pension legislation sets out the minimum death benefit that is payable. However, each Division of the Plan provides for a death benefit that may have a greater expected value. The survivor benefits are outlined in your pension plan booklet.

If you die after pension commencement, any benefits payable will be based on the option you elected at retirement.

Q. I have a separation agreement/court order being drafted but not finalized yet. Can I remove my spouse and designate someone else in the beneficiary form?

Your former spouse may be eligible for a portion of your pension in the event of a marriage breakdown. You can designate a beneficiary for any future pension and any pension your former spouse was not entitled to receive. Please contact your Divisional administrator for a designation of beneficiary form.

Get information about the Teamsters Canadian Pension Plan and other retirement related information