Part 5: Replacement Ratio

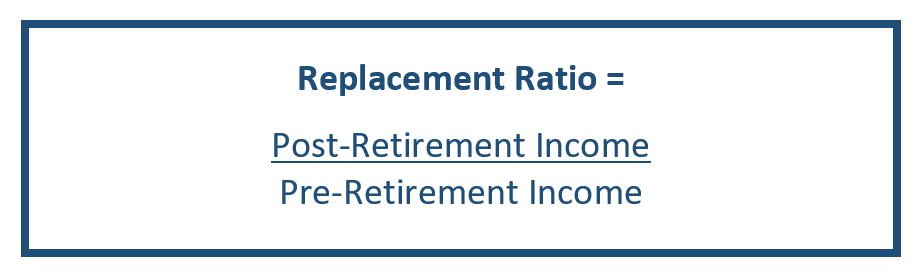

In the last part of the series on the retirement income system, we tie it all together. The three sources of retirement income (i.e. government benefits, personal savings, and workplace pension plans) help us plan for the appropriate level of retirement income we want. Comparing that to what you were earning just before retirement (i.e. your pre-retirement income) is known as your replacement ratio: the percentage of your pre-retirement earnings that will provide you with your desired standard of living in retirement. What is the right replacement ratio to aim for? There is no single correct answer as it depends on your needs at retirement.

There is a wide range of numbers quoted when discussing an “appropriate” replacement ratio. The number has often been pegged at a 70% replacement ratio. This 70% number relates to the outdated limits on pensions that can be provided by a registered pension plan in accordance with the Income Tax Act. Everyone’s needs in retirement are different. Determine the replacement ratio that will work best for you.

Now, you may be wondering, why isn’t the appropriate ratio 100 percent? Why is the income needed during retirement, not the same as when you are working? Generally speaking, some expenses are likely to taper off in or near retirement. For example, your children are likely to be grown, and on their own, your mortgage is paid off or close to, commuting and work expenses like gas and lunches are not as large as when you are working. And, of course, as a retiree, you will no longer be saving for retirement but rather withdrawing from those savings. Lastly, if your income in retirement is lower, so will your taxes.

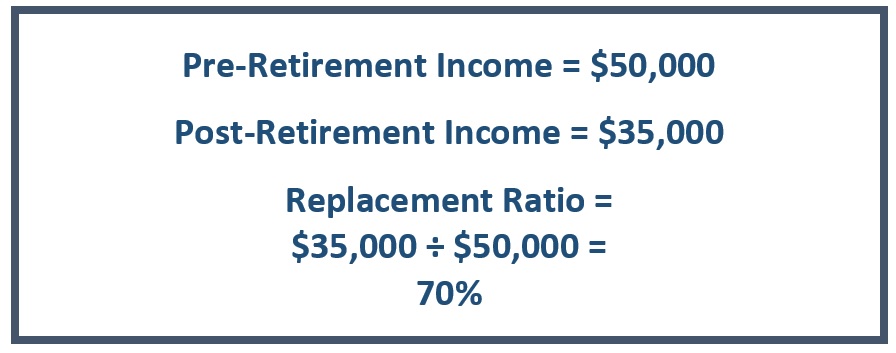

So back to your replacement ratio, will you need 50%, 70%, 90% or even 100% of the income you have in your last year of work to maintain a desirable standard of living after you retire? For example, if your pre-retirement income is $50,000 but your income once you retire is $35,000, you have a replacement ratio of 70% (i.e. $35,000 divided by $50,000).

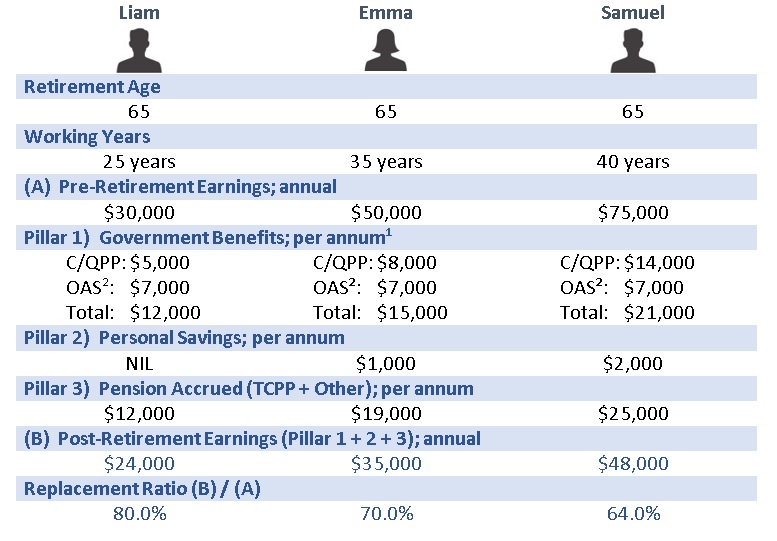

Let’s take a look at the following examples of individuals retiring at age 65 whose post-retirement income meets their needs. What does their replacement ratio look like?

[1] If you start government benefits before age 65, your C/QPP retirement pension will be reduced by 0.6% for each month you receive it before age 65 (7.2% per year).

If you start government benefits after age 65, your C/QPP retirement pension will increase by 0.7% for each month after age 65 that you delay receiving it up to age 70 (8.4% per year). Also, your OAS pension will be increased by 0.6% for each month after 65 you delay receiving it up to age 70 (7.2% per year).

[2] If you retire prior to age 65, the replacement ratio prior to age 65 will not include the OAS as OAS does not become payable until age 65.

When planning for retirement, remember there are different sources of your retirement income, which we have gone through in this series on the retirement income system. The goal of the three-pillar retirement income system is for you to maintain a similar standard of living during retirement that you enjoyed during your working years. No surprises later, start planning for your retirement today!