Part 3: Personal Savings

According to the 2016 Census by Statistics Canada, the majority (65.2%) of Canada’s 14 million households contributed to at least one of three major types of registered savings accounts in 2015, namely registered pension plans (RPPs) registered retirement savings plans (RRSPs), and tax‑free savings accounts (TFSAs).[1]

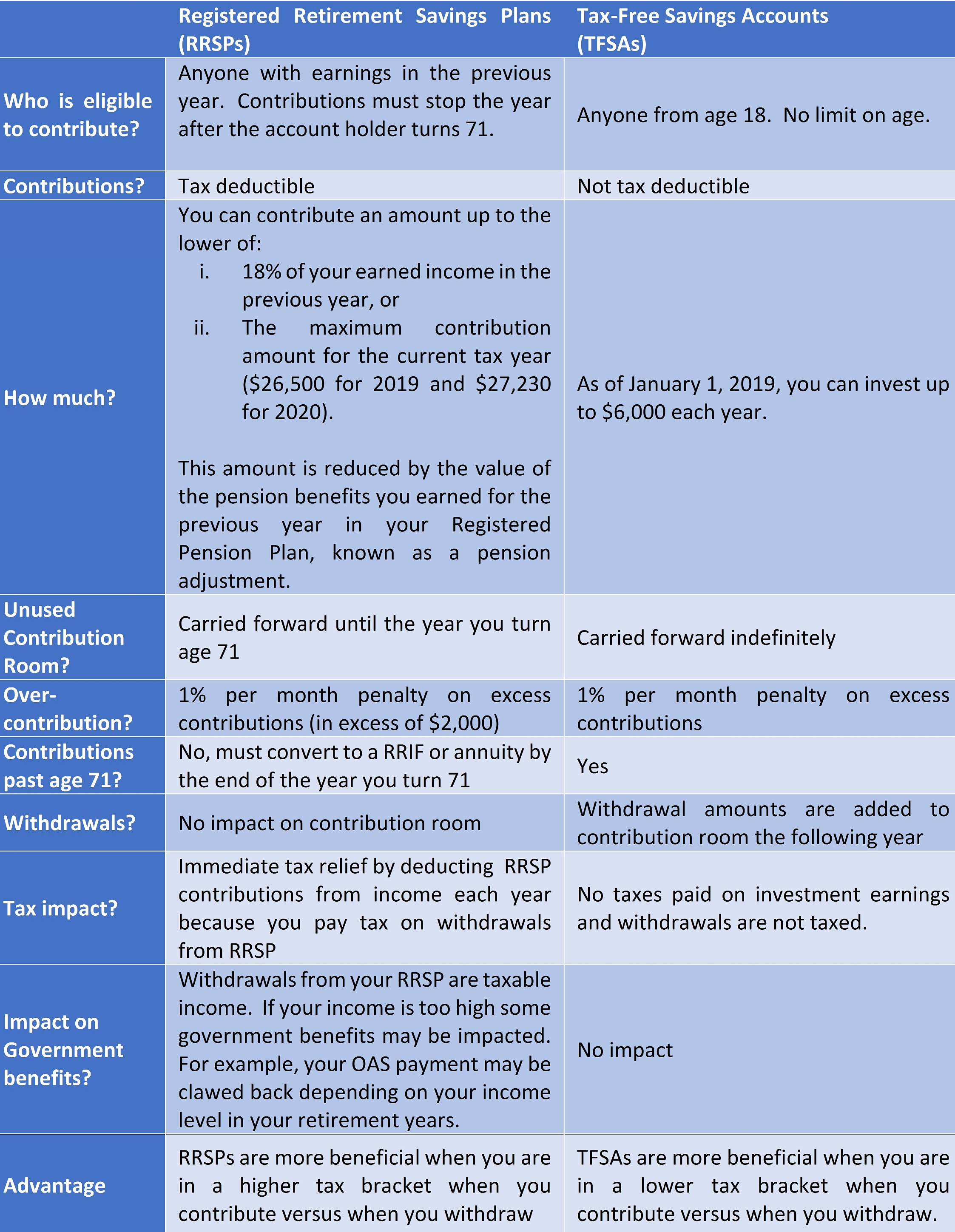

Part 1 of our 5-part series on Canada’s three-pillar retirement income system provided a general overview and Part 2 focused on how government benefits worked. Now in Part 3, let’s turn our attention to personal savings such as RRSPs and TFSAs, which are investment vehicles designed to help Canadians with their personal savings for retirement:

When it comes to saving for retirement, it's never too early to start, and the earlier, the better. Life’s many financial commitments, like a mortgage, rent, car loans, insurance, childcare expenses, and the list goes on, can make it challenging to save for retirement. Have a plan, make a budget, figure out how much money you can afford to save for retirement, and how much money you might need at retirement.

You may wish to seek the guidance of a financial advisor to help you figure out how to budget and which savings vehicle to use.

Part 3 of our 5-part series delved into the details of a couple of personal investment savings vehicles designed for retirement.

Stay tuned for the next installment of our 5-part series on the retirement income system.