You Asked: FAQ to the Pension Plan's Divisional Administrators

1. How do I change my address/beneficiaries?

Each Division of the TCPP has appointed an administrator to handle the day-to-day operations of the Plan, including the maintenance of member records. Please refer to the Contact page to find out who the administrator of your division is to report any changes to your personal contact information. You can also use the online form on this website to report any changes to your contact information.

To change your beneficiaries, you should contact your Divisional administrator to request a designation of beneficiary form. It is important to keep this information current so the Plan can keep you updated about your pension.

2. What is my pension benefit amount?

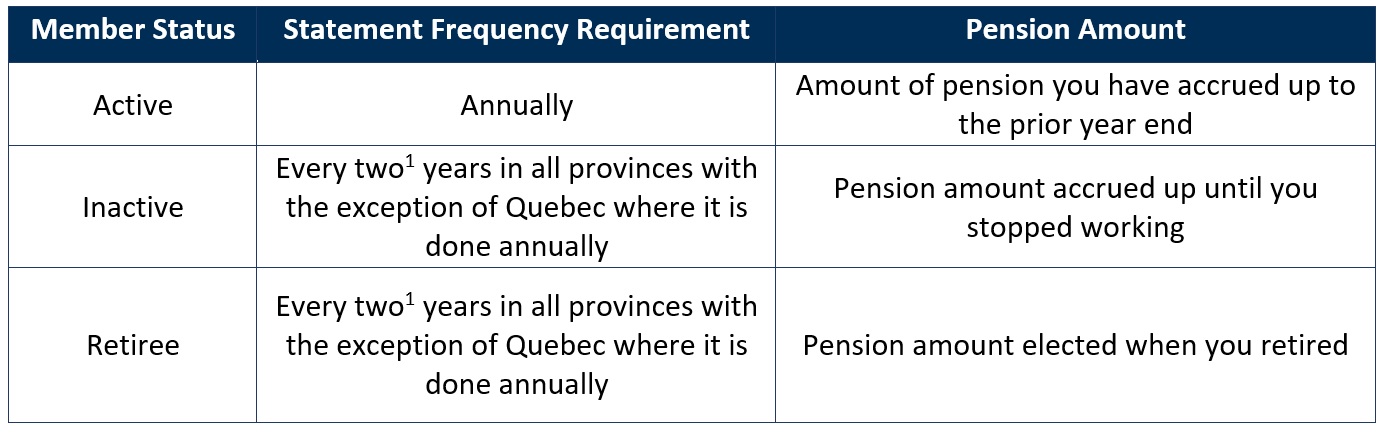

The best place to find how much pension you have accrued is on your pension statement.

[1] Some Divisions prepare statements annually.

Please contact your Divisional administrator if you are unable to locate your statement.

3. Can I take my pension as a lump sum?

If you are younger than age 55 when you leave employment, you have the option to transfer the commuted value of your pension.

If you are over age 55, and qualify for a small pension under applicable pension legislation, you have the option to receive the commuted value of your pension either as a cash lump sum or a transfer from the Plan.

4. When can I retire and what monthly options are available?

The normal retirement age under the TCPP is age 65 and you can retire as early as age 55 with a reduced pension.

The options available to you may vary by division, and can provide more or less protection to your spouse/beneficiary and result in differing pension amounts. The value of your pension (i.e. the present value of future payments) is the same under all options. Please contact your Divisional administrator for details.

5. Why is my pension reduced if I retire early?

Your pension from the Plan is payable starting on your normal retirement date (your 65th birthday). The earliest you can start your pension is your 55th birthday. Retiring early prior to age 65 may result in a lower amount of pension payable as you will receive your pension for a longer period of time.

6. I am leaving my current employer and moving to another company. Can I access my benefit?

After no contributions are made on your behalf for 24 consecutive months you terminate your membership with the Plan. Once 24 months have passed you will receive a termination statement with the options available to you regarding your pension entitlement for the period you worked.

The 24-month period is needed due to the nature of a multi-employer plan. There are times employees change employers within the same plan, or may have period with no work that should not trigger a termination.

However, note that for Quebec members, legislation requires that termination statements be provided within 60 days after the date on which the Retirement Committee has been informed that the member has ceased to be an active member (provided that you are not laid off).

7. What is the difference between a locked-in amount and a non-locked-in amount?

There is a legislative requirement whereby pension benefits must be used to provide retirement income and cannot be received in a lump sum cash amount (locked-in). This is meant to ensure that members use the money for retirement income.

In some circumstances the money is non-locked-in. For example, if your monthly pension payable at age 65 is considered a small pension under applicable pension legislation, then the value of the pension is non-locked in and you will be able to receive the commuted value of your pension either as a cash lump sum or transfer from the plan.

Please contact your Divisional administrator for further details.

8. What is the difference between a Defined Benefit (DB) Plan & a Defined Contribution (DC) Plan?

Refer to our newsletter on Workplace Pension Plan https://teamsterspension.ca/workplace-pension/.

9. What happens to my benefit if I die (either pre-retirement or post retirement)?

If you die prior to retirement, applicable provincial pension legislation sets out the minimum death benefit that is payable. However each Division of the Plan provides for a death benefit that may have a greater expected value. The survivor benefits are outlined in your pension plan booklet.

If you die after pension commencement, any benefits payable will be based on the option you elected at retirement.

10. I have a separation agreement/court order being drafted but not finalized yet. Can I remove my spouse and designate someone else in the beneficiary form?

Your former spouse may be eligible for a portion of your pension in the event of a marriage breakdown. You can designate a beneficiary for any future pension and any pension your former spouse was not entitled to receive. Please contact your Divisional administrator for a designation of beneficiary form.