Part 1: Retirement income system

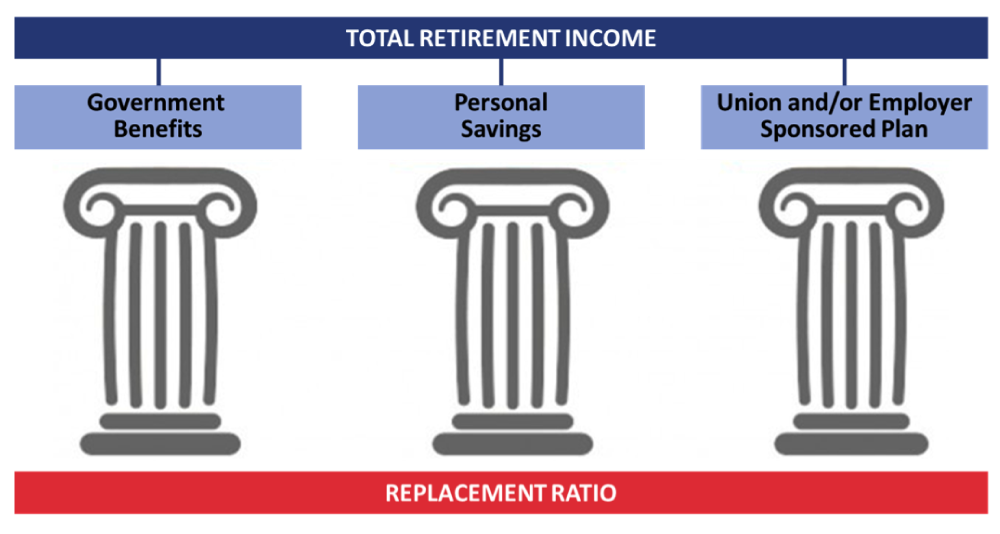

Canada’s three-pillar retirement income system.

The Teamsters Canadian Pension Plan (“TCPP”) aims to provide our workers with a secure pension they can rely on during retirement, but this is only one source of retirement income. If you weren’t a member of the TCPP, where would your retirement income come from? You have probably heard about government benefits like the Canada/Quebec Pension Plan and Old Age Security. Maybe you’ve been setting money aside. And similar to the TCPP, you may have income from other union and/or employer sponsored pension plans.

When planning for retirement, there are different sources of your retirement income. In Canada, this is known as the three-pillar retirement income system.

The goal of the three-pillar retirement income system is for you to retire while maintaining a similar standard of living you enjoyed during your working years. In retirement, you may be planning to transition to a new lifestyle and downsize. Your total retirement income may not add up to the amount you were earning prior to retirement, but that’s okay, because there are less expenses expected in retirement years, so you won’t need as much income. For example, you will no longer have work expenses (i.e. commuting to work, payroll deductions for pension, C/QPP etc.), your mortgage may be paid off, and your income tax bracket will likely be lower. What percentage of your current income do you need to retire comfortably? This is known as the replacement ratio.

Our five-part series on the retirement income system will expand on Government Benefits, Personal Savings, Union and/or Employer-Sponsored Plans, and Replacement Ratio. Stay tuned for the next installment.